michigan property tax rates 2020

Ad OConnor Can Appeal Property Taxes for You. Michigans effective real property tax rate is 164.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Dont settle for high property taxes You only pay if we reduce your taxes.

. According to the Tax Foundation Michigan will have the 13th highest property tax rate in 2020 with a rate effective at 144 percent of a homes value. Rates include special assessments. This booklet contains information for your 2022 Michigan property taxes and 2021 individual income taxes.

2018 Millage Rates - A Complete List. Rates for 2021 will be posted in August 2022. The average millage rate in Michigan.

Follow this link for information regarding the collection of. Property taxes are the. Millage rates are those levied and billed in 2020.

In fact there are two different numbers that reflect your homes value on your Michigan real property. Millage rates are those levied and billed in 2020. Heres a list of the 25 Michigan cities and townships with the highest property tax rate for homeowners.

The Tax Foundation ranked Michigan as having the 13th. Unsure Of The Value Of Your Property. Alcona Alcona Twp 011010 ALCONA COMMUNITY SCH 205108 385108 145108.

Michigan has some of the highest property tax rates in the country. 2019 Millage Rates - A Complete List. The IRS will start accepting eFiled tax returns in January 2020.

2021 Millage Rates - A Complete List. 2021 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP COUNTY. 2020 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Lee Twp 031120 ALLEGAN PUBLIC SCHOOL 317465 497465 257465 377465 357465 537465.

Median property tax is 214500. On February 15 2023 penalty of 3 will be added. Ad Find County Online Property Taxes Info From 2022.

Counties in Michigan collect an average of 162 of a propertys assesed fair. Rates include special assessments levied. Rates include the 1 property tax administration fee.

The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. Find All The Record Information You Need Here. Michigan local governments are heavily dependent on the property tax and the state levies a property tax as well.

100 Homestead Tax Rate 234813 Summer Only Non-Homestead Tax Rate 413329 Summer Only Winter Tax Rate 106380 Winter Only 2021 Summer Winter Homestead. Rates for 2021 will be posted in August 2022. Enroll In 3 Minutes or less.

2020 MBT Forms 2021 Michigan Business Tax Forms. But rates vary from county to county. The Michigan Treasury Property Tax Estimator page will experience possible downtime on.

When claiming the Michigan property tax credit you need to file form 1040CR along with your income taxes. Beginning March 1 2023 all unpaid taxes are considered delinquent and are payable with additional penalties to Oakland County Treasurer. Local government officials have responded to Michigans tax limitations which constrain growth in the property tax base by seeking and often receiving increases in tax.

Rates include the 1 property tax administration fee. 2020 Millage Rates - A Complete List. Alcona Alcona Twp 011010 ALCONA COMMUNITY SCH 193869 373869 133869.

The State Education Tax Act SET requires that property be assessed at 6 mills as part of summer property tax. 2019 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP COUNTY. The Great Lake States average effective property tax rate is 145 well above the national average of 107.

This interactive table ranks Michigans counties by median property tax in dollars percentage of home value and percentage of. Property Tax Estimator Notice.

Visualizing Unequal State Tax Burdens Across Maps On The Web State Tax Finance Function Tax

Find The Best Business Loan In Outram Money Lending Finance Loans Real Estate Investing

National Level Real Estate Forecast Real Estate Real Estate Information Real Estate Prices

Detroit S High Property Tax Burden Stands As An Obstacle To Economic Growth Citizens Research Council Of Michigan

State And Local Tax Collections State And Local Tax Revenue By State

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

State Corporate Income Tax Rates And Brackets Tax Foundation

Michigan S Property Tax Burden And How It Has Changed Over Time Citizens Research Council Of Michigan

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractor Bookkeeping Business Small Business Accounting Small Business Bookkeeping

Tax Bill Information Macomb Mi

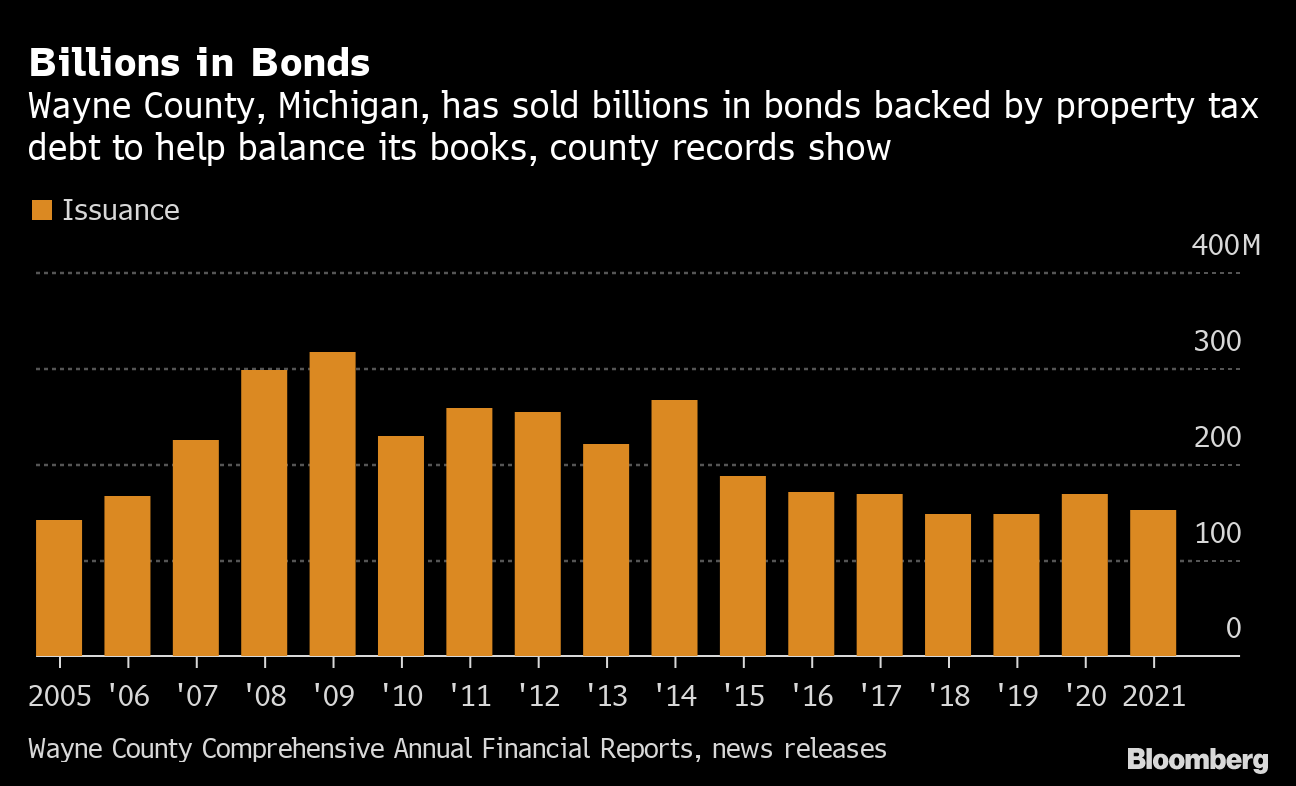

Property Tax Debt Scheme Minority Families Lose Homes To Money Machine Bloomberg

That S Who We R What We Care About National National Association Caring

Reminder Letter Format Check In Once Again A Day Or More After The Due Date Simply To Offer A Suggestion O Lettering How To Make Letters Letter Templates Free

How Do I Qualify For The Largest Mortgage Filing Taxes Tax Preparation Mortgage